Strategy April 28, 2015

Growth Mode

Advantages’ 2015 Compensation Survey shows that the earnings of industry sales pros are on the rise – plus other exclusive insights that reveal the story behind the selling.

Greg Singleton is the architect of his own success.

The national account executive for HALO Branded Solutions (asi/356000) had a strategic plan for powering his career – and results for his clients – to unprecedented heights. Even more importantly, he executed the plan.

The result? A massive $700,000 increase in year-over-year sales in 2014.

A multimillion-dollar biller, Singleton engineered the revenue surge, in part, by digging deeper into existing accounts, which include Fortune 100 companies that see him as a vital extension of their marketing teams. “There is no luck in Greg’s success,” says Dale Limes, senior vice president of sales at HALO. “He knew where he was going. He saw the end result. And, he produced it.”

Throughout the promotional products industry, proactive sales professionals like Singleton took charge of their professional destinies last year and the results were impressive.

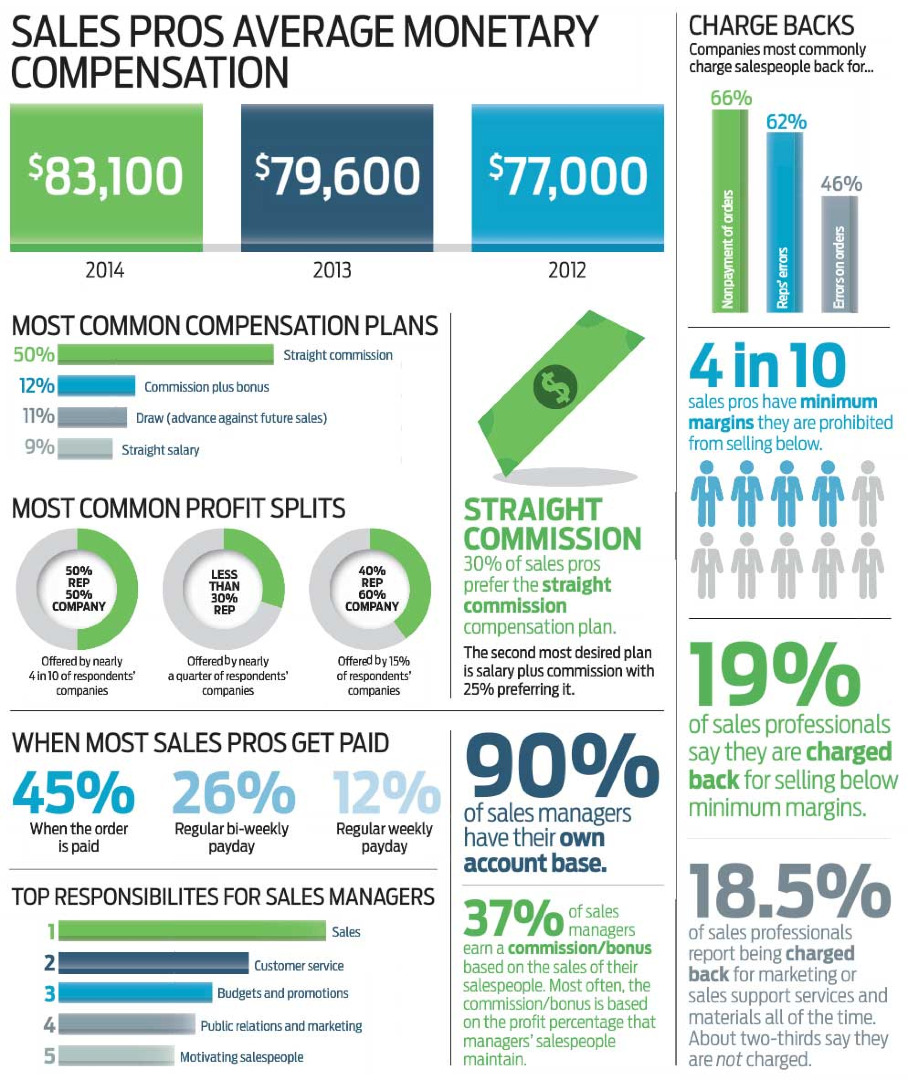

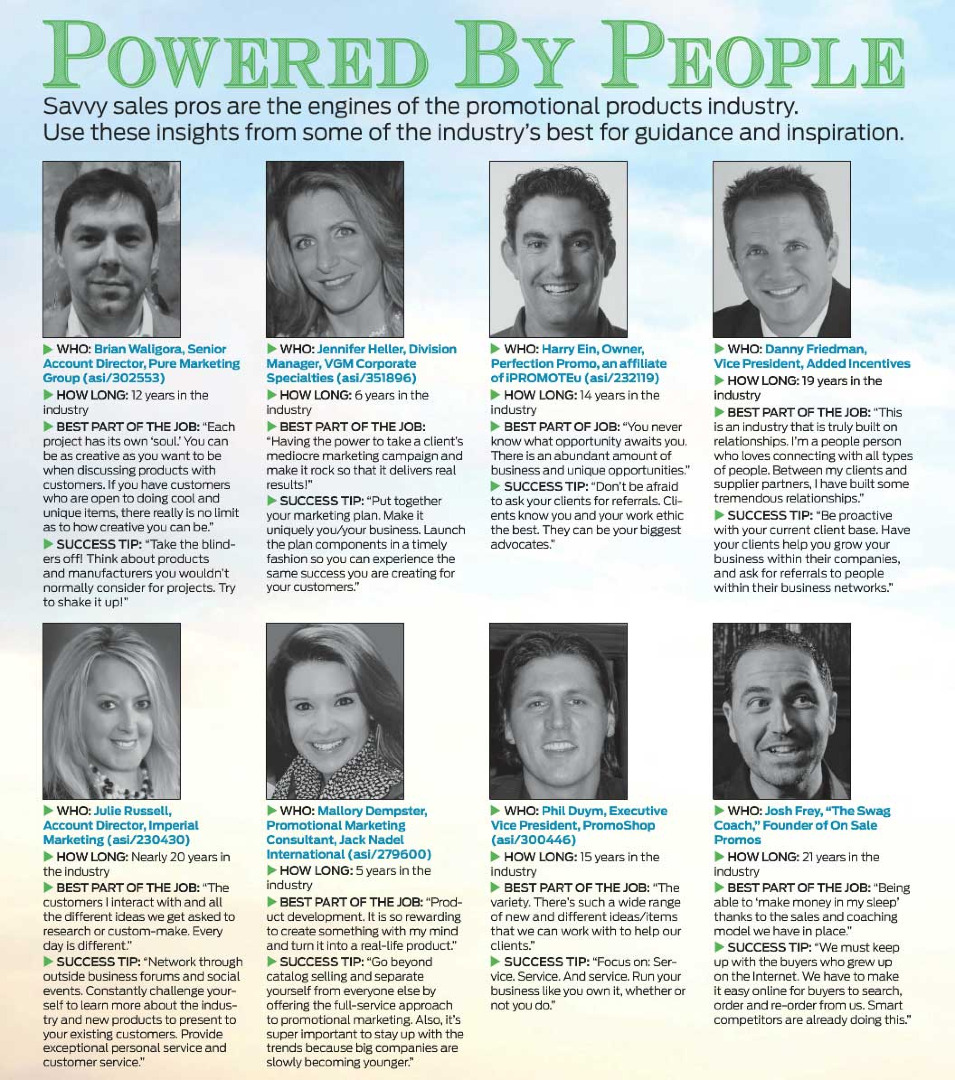

Average monetary compensation for reps and managers in 2014 rose 4.3% to $83,100 – the highest tally in the last six years. The rate-of-increase was a percentage point greater than the rate-of-rise in 2013, meaning compensation gains accelerated at a quicker pace in 2014. Significantly, last year’s average compensation in the promo sales arena eclipsed the national average, which put the pay bump for private industry wages and salaries at 2.2%, according to the U.S. Bureau of Labor Statistics. “We’re in a great industry,” says Harry Ein, owner of Perfection Promo, an affiliate of iPROMOTEu (asi/232119). “It can be extremely lucrative.”

The insight into sales professionals’ earnings is a key component of Advantages’ 2015 Compensation Survey. Specific to the promotional products industry, the exclusive study shines a spotlight on everything from sellers’ outlook for 2015 to industry trends on working from home, how sales pros are paid, how profits are split and much more. Read on for insight into the industry’s evolution.

Feeling Good

For Jennifer Heller, 2015 is shaping up to be a banner year. With a strong client base and a pipeline packed with quality prospects, the division manager at VGM Corporate Specialties (asi/351896) sees ample opportunity for sales growth. “It’s looking like we’ll be up 5% to 10%,” says Heller.

Fortunately, Heller’s optimism is indicative of the positive view many industry sales professionals have for the year. Nearly 40% of reps and managers expect their earnings to increase. That’s better than last year when about a third anticipated a compensation rise. Importantly, for 2015, another 57% of sellers expect their earnings to hold steady.

The confident outlook is being fueled, in part, by a sunnier economic climate. “The economy as a whole is doing better, and when the economy does better, companies spend more money to compete,” says Phil Duym. PromoShop’s (asi/300446) executive vice president of sales for Detroit/Canada expects to grow his sales within several markets, including automotive and the adult beverage industry.

“Automotive is doing great, spirits is doing great,” says Duym. “I would say it’s going to be an ‘up’ year.”

The Home Office

Across industries, working from home has proliferated in the age of ubiquitous smartphones and constant digital connectivity. The promotional products sector is in line with this dynamic.

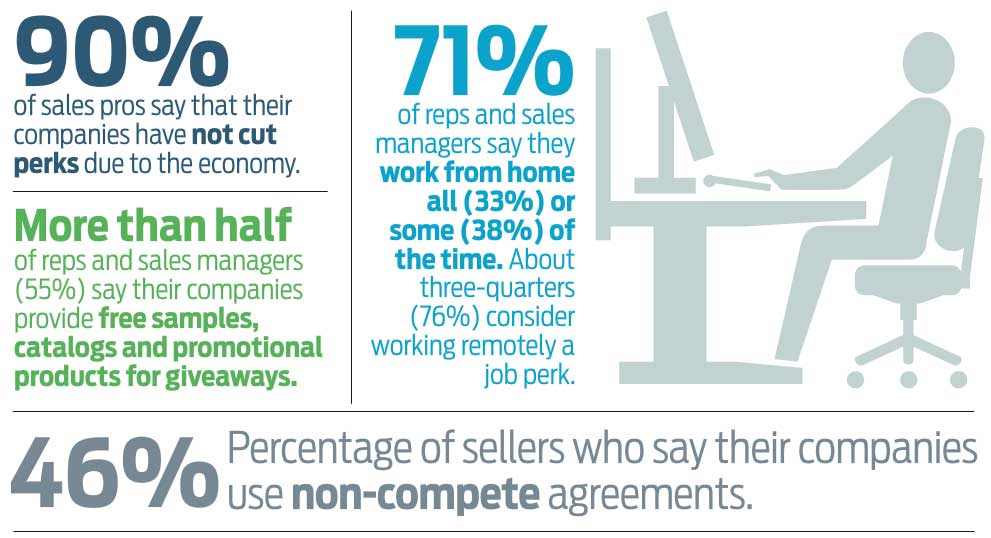

More than 70% of reps and managers say they work from home. A third of survey respondents say they always work remotely. Another 38% say their workday plays out away from a company office part of the time. Certainly, sellers like having the opportunity to work from home, with 76% of respondents considering it a job perk.

“It’s great for me because I don’t waste time commuting and I can focus better,” says Ein. He has a cozy home office equipped with everything he needs. “I can completely focus there – work late at night or early. But when the day’s work is done, I can go right into spending quality time with my son.”

Danny Friedman is a telecommuting fan, too. The vice president for Added Incentives occasionally works from home. “It makes me more efficient,” he says. “It gives me the flexibility to best manage everything that’s on my plate.”

Nonetheless, it would be wrong to assume that all reps and managers inherently prefer working remotely. Brian Waligora appreciates being able to telecommute, but he would rather be in the office. “I love going in,” says Waligora, senior account director at Pure Marketing Group (asi/302553). “It keeps me grounded, keeps me on a schedule. But even more than that, we have a great group of creative people. We bounce ideas around and help each other.”

Seeking Straight Commission

A subtle shift is underway in how sales professionals desire to be paid. Encouragingly, it could be the harbinger of sellers’ growing confidence in the fertility of the marketplace.

Back in 2013, a quarter of sales pros desired to be paid straight commission. But by this year, the percentage had climbed five points to 30%, making straight commission the single most preferred compensation model in the industry. That represents a shift from last year, when “salary plus commission plus bonus” was voted the most desirable compensation package. Some industry insiders say the change could be the result of sellers’ rising confidence in their abilities to exceed sales goals. “There is more earning potential with straight commission,” says Julie Russell, account director at Imperial Marketing (asi/230430). “Straight commission really challenges you, too. You have to be excited by that challenge.”

Overall, half of survey respondents say they are paid straight commission. The other half typically receive commission plus bonus (12%), a draw against future sales (11%) or salary plus some other form of compensation, such as commission (6%) or bonus (5%). Duym’s PromoShop team members are among the industry aces who receive a bonus in addition to their normal pay. “Once we hit certain revenue targets, they receive bonuses accordingly,” he says. “It’s a tiered system. So the better things go, the more bonus they get. It’s a great motivator.”

The Profit Pot

Of course, a critical component of compensation is profit split. And when it comes to dividing margins between sales pros and companies, a 50/50 split is most common. Some 38% of reps and managers say this divvy is offered by their companies – consistent with last year’s findings.

As with much of the industry, the typical split at Added Incentives is half-and-half, says Friedman. Still, Added Incentives didn’t adopt that structure simply because it is pervasive; analysis has shown it is optimum for the distributorship. “We’ve determined that this is what makes us most profitable,” he says.

While 50/50 is the plurality among profit division models, it’s most common for companies to offer margin splits slanted in their favor. About two-thirds of respondents’ distributorships offer splits in which sales pros’ take home less than half of the profit. On the other end of the spectrum, only 5% of companies allow sellers to keep more than 65% of the margin. American Solutions for Business (asi/120075) is among the select five percenters. Reps there have the potential to pocket up to 75% of the gross profit. “This model provides tremendous incentive,” says ASB executive J.P. Shea.

While the breakdown on profit splits largely remains consistent with years past, the industry’s handling of minimum margins is changing. Back in 2010, 56% of sellers had minimum margins they were prohibited from selling beneath. But this year, only four in 10 sales pros are given a ground floor on margins. Many reps view the trend positively. “It’s nice to not have those restrictions,” says Waligora. “Every customer is unique. To serve each best, you have to be adaptable.”

Supports and Benefits

To help sellers adapt and succeed, many companies provide reps and managers with robust backing. Indeed, about two-thirds of sales pros say they are not charged for marketing or sales support services and materials.

Russell values the backing she receives from Imperial. The samples, self-promotional materials and catalogs imprinted with the Imperial logo help fuel her selling efforts. “It’s a partnership, and the support I get is extremely helpful,” Russell says.

Ein feels similarly about iPROMOTEu. The back-end management assistance the company provides frees Ein to focus on what he does best: close deals. “I have an excellent inside assistant that I get tremendous help from,” he says.

Industry-wide, the benefits distributorships are most likely to offer include free samples, catalogs and promotional products for giveaways (55% of respondents say companies offer these), paid trips to trade shows (39%) and health insurance (35%). Gifts at cost (31%), self-promotion budgets (30%) and 401(k) or similar (29%) are other benefits.

At PromoShop, Duym’s team receives perks like full medical coverage and trips to industry trade shows. The trips are important, he says, because trade shows deliver an excellent forum for relationship-building with suppliers and learning about hot new products. Plus, it gives reps a chance to socialize with fellow sales pros. “You come back even more enthusiastic about the job,” says Duym. “That enthusiasm translates into stronger performance.”

Christopher Ruvo is a senior writer for Advantages magazine. Follow: @ChrisR_ASI. Contact: cruvo@asicentral.com