8 Million

The number of Americans who work in the financial services sector.

(Zippia)

It’s certainly been a rollercoaster ride for the promo financial market this past year. Persistently high inflation, rising interest rates and a turbulent stock market (particularly in high-profile industries like tech and crypto) all put pressure on this sector to assuage nervous consumers, as they face decreases in disposable income, geopolitical tumult and a possible recession. And that was all before last month’s financial crisis that led to the failures of multiple institutions – most notably Silicon Valley Bank.

And yet, the myriad challenges present opportunity for promo campaigns for the nearly 8 million Americans who work in this industry. There’s been a growing demand for trustworthy financial professionals who can help consumers navigate choppy waters, and they’re looking to re-engage with current and potential customers on the other side of the pandemic. Meanwhile, firms of all types and sizes continue to vie for top-tier talent, pointing to an ongoing need for employee engagement efforts.

Product Pick

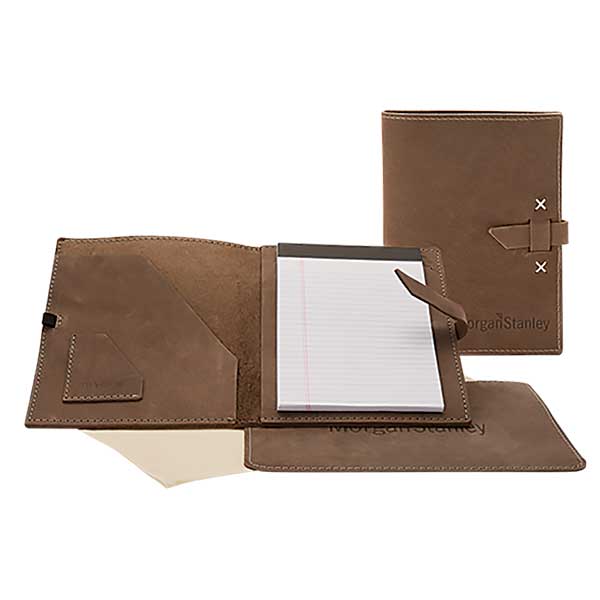

BOTH NEW AND LOYAL CLIENTS will appreciate this leather padfolio and mouse pad set (TGSBAILIWICK) as a gift from their financial advisor, especially if it’s personalized.

Product Pick

QUALITY OUTERWEAR like this thermal shell (AFH-1/AFH-1W) branded with the financial firm’s name makes a great addition to company stores, where it can be accessed by customers and employees alike.

4 Distributor Tips

Mike Fossano, vice president of account services at Premier Communications Group (asi/298496), has extensive experience with a number of clients in the finance and insurance sectors, particularly those that serve niche audiences. Here are four of his tips for serving this discerning clientele.

1 Help clients re-engage with customers. Finance clients are again heading to events and one-on-one meetings, and that’s leading to increased demand for engagement items. “They want to re-introduce the brand in a cool way after COVID,” says Fossano. “Loyalty campaigns remind people who our client is.”

2 Look to specialty markets. Approach local credit unions and insurance companies that cater to specific groups. “They too have conferences and associations,” says Fossano. “We’ve found a niche in identifying certain sub-markets in larger industries, ones that don’t typically look to put themselves out there.”

3 Encourage gifting all year round. “People like to receive a gift out of the blue or an opportunity to redeem one,” says Fossano. “They’re very responsive to that, and it gives our clients the chance to follow up with them. Requests are increasing for virtual storefronts, so they can use those for redemption.”

4 Pitch different price points. Clients in this space can range from large organizations with locations across the country, to the agent with a corner storefront on Main Street. Be sure to come with a variety of products at varying pricing tiers so you can meet their unique needs.