News October 29, 2021

Q3 Promo Sales Increase by Over 18%

The performance marked the second straight year-over-year quarterly rise, with industry revenue climbing closer to pre-pandemic levels.

Bob Lilly Jr. is smiling – and with good reason.

The Garland, TX-based promo products distributorship he leads, Bob Lilly Promotions (asi/254138), increased sales 26% in the third quarter of 2021 compared to the same quarter the prior year.

The success was the result of continued strength in direct mail kitting sales, a rise in in-person events and a sharp increase in business related to the firm’s NFL licensing deals.

“We had our best month in 22 years during September, and it looks like October has a chance to beat it,” Lilly says. “We’re excited about the growth we’re experiencing and look forward to closing the books in January on our best year since 2015.”

Lilly’s revenue growth in Q3 – along with his optimism for a strong close to 2021 – are indicative of the sales performances and outlooks of a majority of North American distributors.

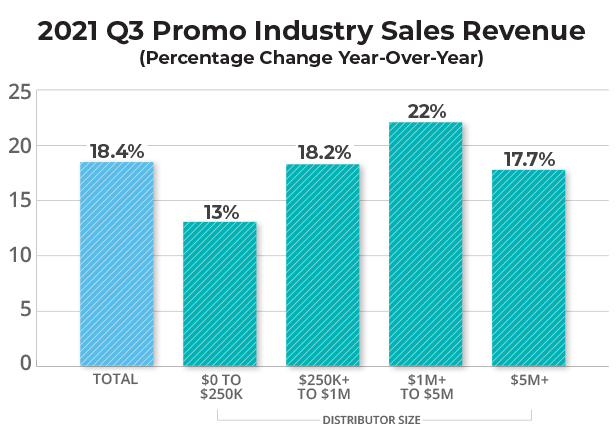

The just-released ASI Distributor Quarterly Sales Survey shows that promo distributors increased sales, on average, by 18.4% in the third quarter of 2021 compared to the same three-month span in 2020.

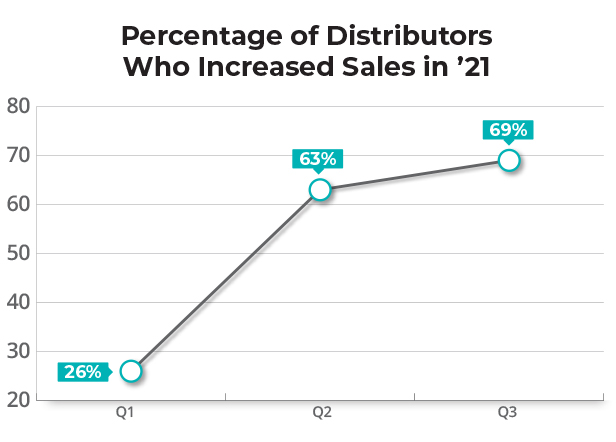

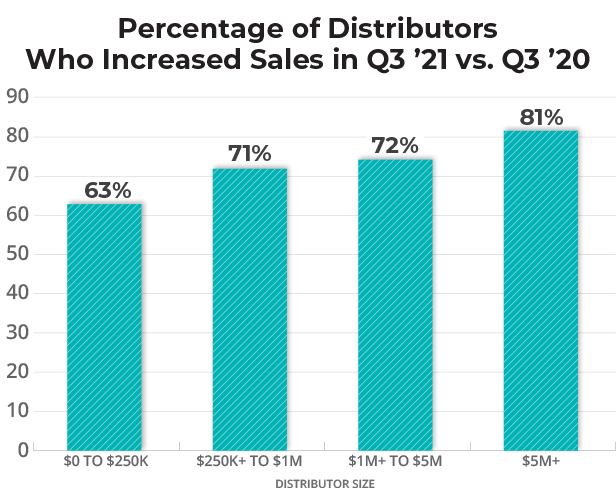

Importantly, the average increase wasn’t driven by gains at just select large firms, but rather was a result of nearly seven in 10 distributors achieving quarterly sales rises.

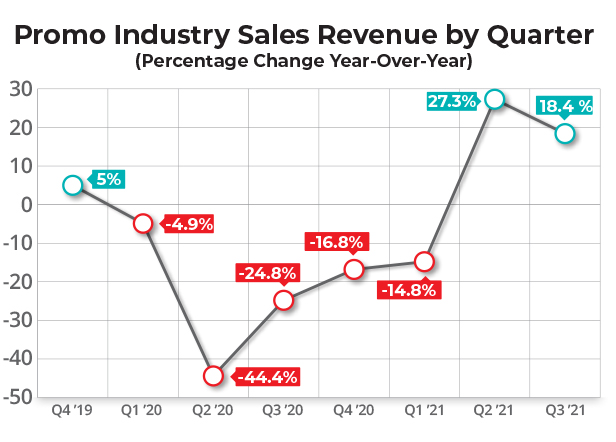

The expansion marked the second straight quarter of year-over-year growth, following five consecutive quarters of declines owing to the COVID-19 pandemic. The strength of Q3 sales even came as a pleasant surprise to many, with nearly half of distributors saying their quarterly revenue performance exceeded expectations.

Chicago-based Top 40 distributor Zorch (asi/366078) was among the industry firms that scored large-scale success in the third quarter.

“Our sales were up about 55%,” says CEO Mike Wolfe. “It was thanks to onboarding new corporate programs and a return to normal spend levels from several of our long-standing accounts. We’re experiencing record bookings for October, so if that’s a good indicator, the fourth quarter should go very well, too.”

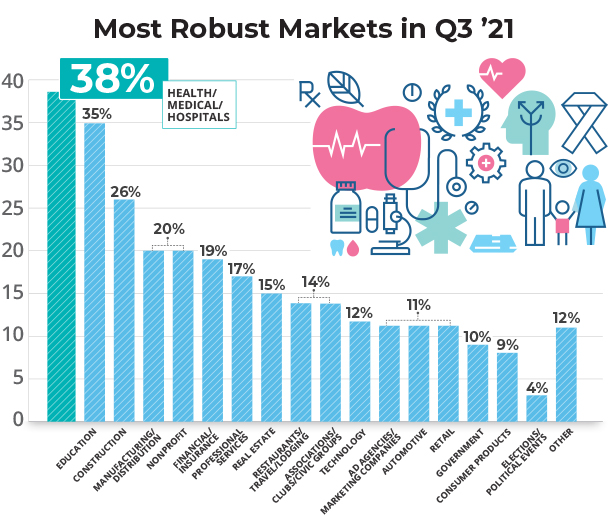

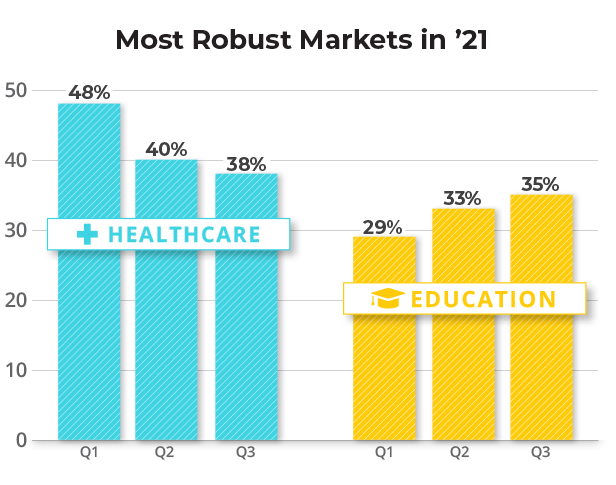

Distributors found receptive buyers across a variety of markets in the third quarter. Top among those were healthcare, education, construction, manufacturing and nonprofit. While healthcare was named the most robust market in all three quarters this year, education continues to gain on it – perhaps signaling the return of what was the top promo market for six straight years, until 2020.

While personal protective equipment (PPE) factored into sales for some in Q3, distributors generally say their revenue increases were a result of business centered on traditional promotional products.

“Our sales are trending up about 11% over 2020. A return to regular promo, with less reliance on PPE, has been pivotal to that growth,” says Gregg Emmer, vice president and chief marketing officer at Batavia, OH-based Top 40 distributor Kaeser & Blair (asi/238600).

‘On the Right Track’

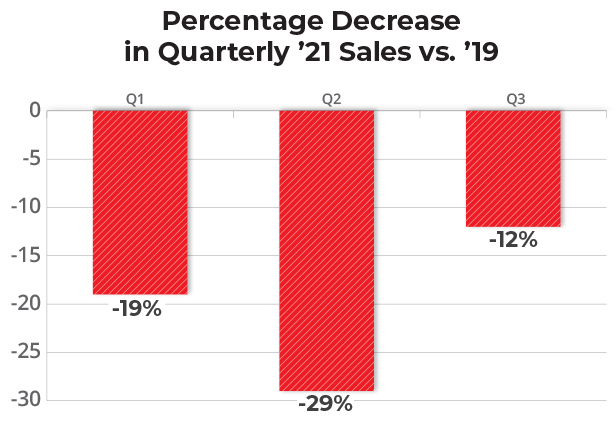

For distributors, sales growth in terms of year-over-year quarterly expansion was slower in Q3 2021 than in Q2 2021, when sales jumped 27.3%. However, Q2 was an anomaly because during the COVID-driven societal shutdowns of Q2 2020 sales took a massive nosedive – down 44.4%. Meanwhile, in Q3 2020, sales were starting to recover thanks to PPE and the return of some promo business. Because of that difference, explains Nate Kucsma, ASI’s executive director of research and corporate marketing, it was harder to have as robust year-over-year quarterly growth in Q3 2021.

“What’s very encouraging is that the difference between 2021 and 2019 has shrunk,” Kucsma notes. “Q2 2021 sales were down 29% compared to Q2 2019, while Q3 2021 was down only 12% compared to Q3 2019. That means promo is getting closer to pre-pandemic 2019 sales levels, when distributors had record annual revenue of $25.8 billion. It’s an indicator that the industry is on the right track and we’re getting closer to ‘normal.’”

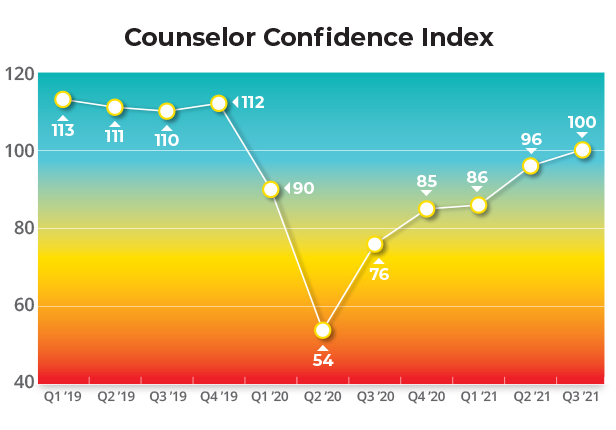

Confidence is increasing accordingly.

The Counselor Confidence Index, which measures distributors’ financial health and optimism, reached its highest level since the pandemic began in the third quarter of 2021. The reading of 100 gets the index back to its baseline and is nearly double what it was during the depths of Q2 2020, its lowest-ever point in about 20 years of record-keeping.

The Icebox (asi/229395), an Atlanta, GA-based distributor, generated sales growth of 48% in Q3 2021 compared to the third quarter of 2020 and 5% compared to Q3 2019. President/CEO Jordy Gamson expects the positive trend to continue.

“We are seeing more customers coming back from COVID, and we’re adding new customers,” says Gamson, noting the firm’s quarterly sales have increased sequentially as well, with this year’s Q3 better than this year’s Q2. “We anticipate that Q4 will be the strongest quarter of the year,” he adds.

Gamson’s confidence about 2021 performance is being felt broadly.

Nearly three-quarters of distributorships believe their 2021 annual sales will outpace 2020. The optimistic growth projections are fairly consistent among distributors of varying sizes. For example, 71% of promo distributors with yearly revenues of $250,000 or less believe annual sales will be up, while 74% of distributors that generate $5 million or more in revenue believe the same.

The nearly 20% annual sales decline that distributors experienced for the whole of 2020 increasingly appears to be an outlier due to the pandemic. As such, some industry executives feel it’s even more encouraging that nearly half (49%) of distributors believe that their 2021 sales will beat not only that down year, but also 2019 – the last pre-pandemic year.

49%

PERCENTAGE OF DISTRIBUTORS WHO EXPECT THEIR 2021 SALES TO SURPASS 2019.

“We have continued to gain momentum throughout 2021,” says Lisa Hubbard, vice president of sales and marketing at Newton, IA-based Top 40 distributor The Vernon Company (asi/351700). “Customers are finding their new norm, and we continue to see increased engagement from our sales team and clients.”

Challenges Persist

Promo’s third-quarter growth far surpassed that of the American economy. U.S. gross domestic product grew at an annualized rate of just 2% in Q3, according to a late October estimate from the U.S. Department of Commerce.

Economists say the delta variant of COVID-19, supply chain disruption, inflation, labor shortages, an anemic increase in consumer spending and other factors contributed to the GDP growth rate retreating nearly 5 percentage points from Q2’s 6.7% year-over-year expansion.

Certainly, promo pros know all about the supply chain fiascos.

The issues have included soaring costs for shipping/ocean freight, importing delays caused by everything from port congestion to lack of space on cargo ships, unfavorable monetary exchange rates, reduced factory productivity in China, rising raw-material prices, insufficient labor levels and inadequate domestic transport capacity.

For promo, the repercussions in 2021 have been inventory shortages, higher product prices, lower customer service levels, longer production times, shortages of important decorating materials like screen-printing ink, and delays in order delivery.

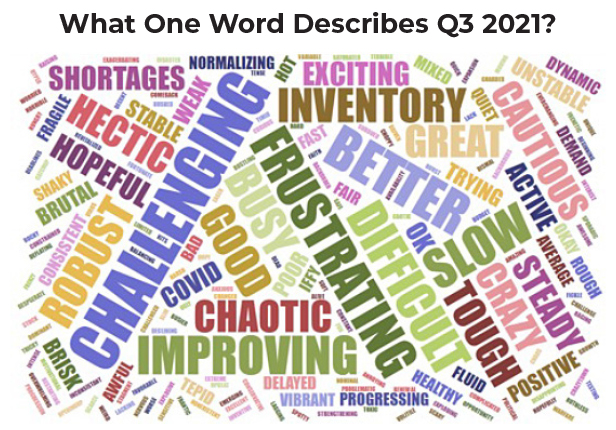

Indeed, distributors continued to contend with such challenges in Q3, and are again battling them in the fourth quarter. That’s made business more challenging, frustrating and, some say, “chaotic.”

While believing that the fourth quarter will be a period of sales expansion, certain executives say that the supply line issues may hold back what could have ended up being even greater Q4 revenue acceleration.

“Our pipeline for Q4 looks fairly robust, but supply chain shortages will make it increasingly difficult to meet demand and probably curb some of the recovery,” says Lilly. “Those supply chain issues include shortages of product, but also very poor communication from suppliers, which could be damaging to customer relationships.”

For some, bringing new quality employees aboard has proved difficult. “We’re finding it challenging to hire great talent,” notes Lilly.

Hubbard says it’s been harder to hire, from the local area, employees with the backgrounds that are needed to help propel aspects of The Vernon Company’s ongoing technology enhancements.

“We’ve been somewhat fortunate so far, but it is a challenge,” Hubbard says. “This opens us up to broadening our scope to remote workers, while trying to maintain strong company culture, close interpersonal relationships, cohesion, and important side conversations you sometimes can’t achieve on Zoom conferences. It’s certainly not impossible, but it is a new opportunity we’ve had to navigate.”

Despite the hurdles, distributors are in general agreement that their companies and the industry are in a much healthier place than a year ago. With industry indicators good and economists predicting a return to faster growth for the U.S. economy amid the wane of the delta variant, distributors are upbeat that even better days are ahead.

“2021,” says Hubbard, “is the year of learning and allowing these new challenges to really make you stronger as a business.”

Stay Ahead of the Curve

Subscribe to ASI's industry-leading newsletters.

All the award-winning content from ASICentral and Print & Promo Marketing, delivered right to your inbox.